maine excise tax rate

Excise Tax is calculated by multiplying the MSRP by the mil rate as shown below. Statutes concerning Maines retail sales tax Rate 5 Sales tax rate varies based on the state.

Excise Tax Information Cumberland Me

As of August 2014 mil rates are as follows.

. 18 rows Commercial Forestry Excise Tax. In Maine beer vendors are responsible for paying a state excise tax of 035 per gallon. No additional local municipal taxes are.

Marijuana tax rates in Maine Adult-use retail. 1 CNG Hydrogen and Hydrogen CNG tax rate is applied to every 100. YEAR 1 0240 mil rate YEAR 2 0175.

Cigarettes are also subject to Maine sales tax of approximately 035 per pack. Maines general sales tax of 55 also applies to the purchase of beer. This calculator will allow you to estimate the amount of excise tax you will pay on your vehicle.

Maine Property Tax Institute - AprilMay 2022 Maine Property Tax School August 2022 IAAO Course. This calculator is for the renewal registrations of passenger vehicles only. The excise tax rate is.

The excise tax due will be 61080. To calculate your estimated registration. Purchases are subject to a 10 marijuana excise tax plus the statewide 55 sales tax.

2721 - 2726. The rates drop back on January 1st each year. Besides prepared food lodging and liquor there are.

There is a 5 percent growth rate. Maine Cigarette Tax - 200 pack. Excise Tax is an annual tax that must be paid when you are registering a vehicle.

Property Tax Educational Programs. Contact 207283-3303 with any questions regarding the excise tax calculator. Maine Beer Tax - 035 gallon.

Fall 2022 Certified Maine Assessor CMA. A registration fee of 3500 and an agent fee of 600 for new vehicles will also be charged for a total of 64180 due to register your new vehicle. Mil rate is the rate used to calculate excise tax.

2019 -- 1000 per 1000 of value. Calculation will be based on. Departments Treasury Motor Vehicles Excise Tax Calculator.

WATERCRAFT EXCISE TAX RATES Commercial Tax 300 300 Tax 300 Tax 350 Tax 500 650 1000 Tax 550 700 1050 Tax 650 800 1150 Tax 750 900 1250 Tax 900 1050 1400 Tax. Share this Page How much will it cost to renew my registration. HOW IS THE EXCISE TAX CALCULATED.

Boat Excise Tax Requirement To Eliot In Lieu of Maine Boat Registration or Federal Documentation. 04 Tax and interest 05 Filing and payment 06 Appeals 01 General Maine imposes an excise tax on all qualified telecommunications equipment located in the State. How much will it cost to renew my.

2018 -- 650 per. In Maine cigarettes are subject to a state excise tax of 200 per pack of 20. The calculator below will help give you an idea of what it will cost to renew the current registration on your passenger vehicle.

All boat owners who have boats registered in a state other than the State of. Please note this is only for estimation purposes -- the exact cost. 2021 -- 1750 per 1000 of value.

2020 -- 1350 per 1000 of value. 2022 -- 2400 per 1000 of value. Except for a few statutory exemptions all vehicles registered in the State of Maine are subject to the excise tax.

Visit the Maine Revenue Service page for updated mil rates.

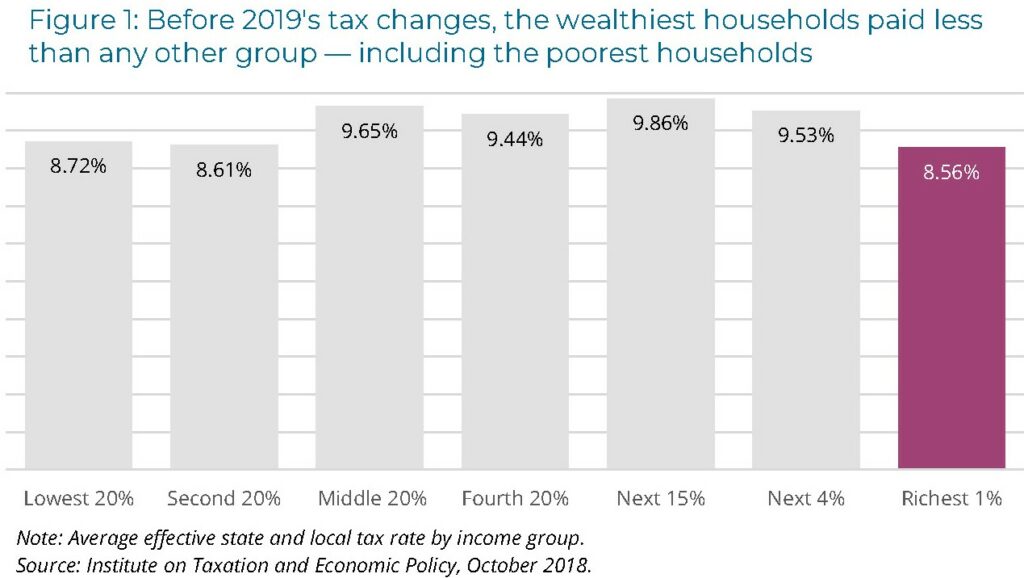

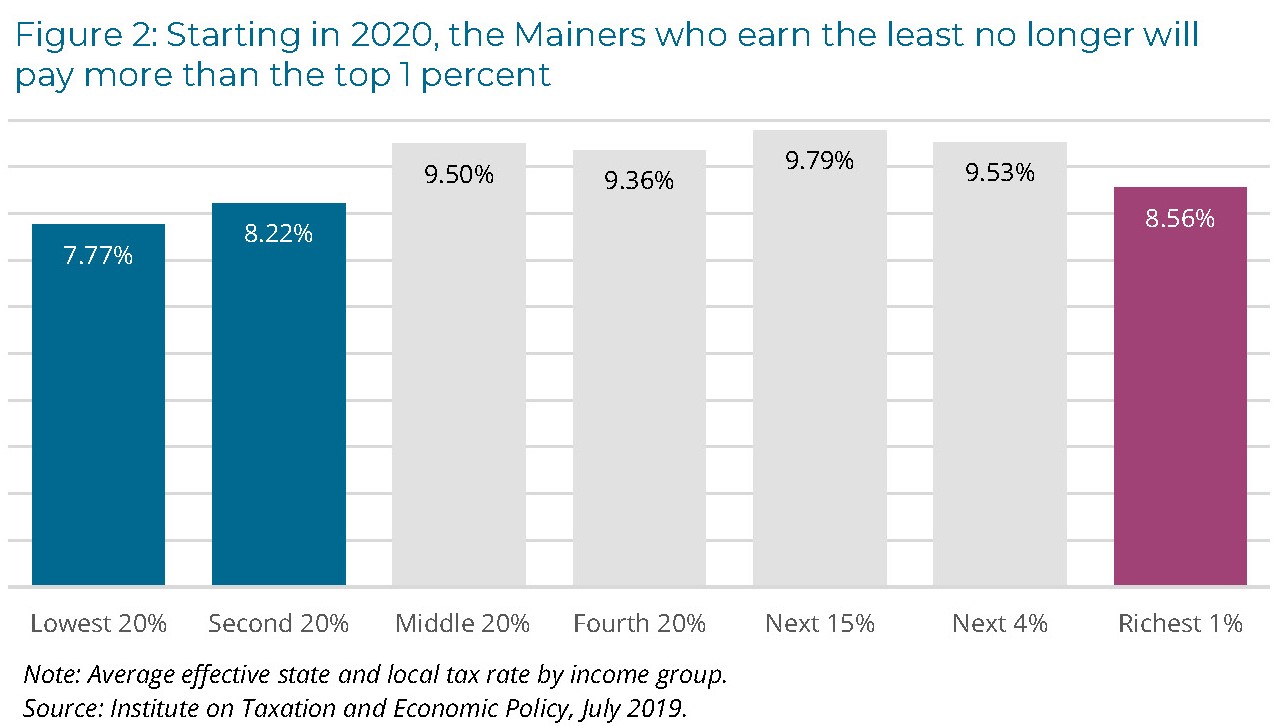

Maine Reaches Tax Fairness Milestone Itep

Maine S Tax Burden Is One Of The Highest New Study Says Mainebiz Biz

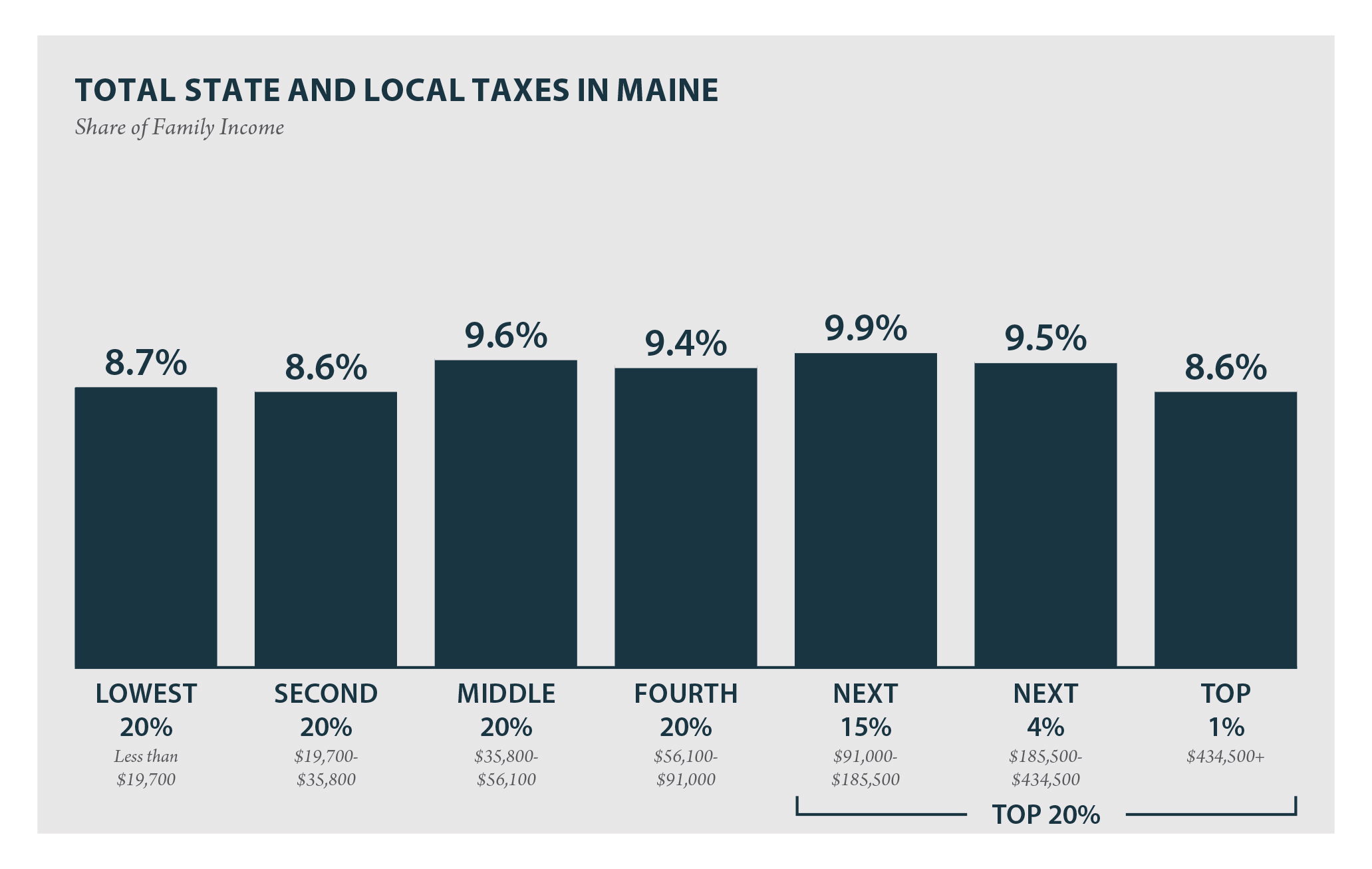

Maine Who Pays 6th Edition Itep

How Much Does Your State Collect In Excise Taxes Per Capita Tax Foundation

Maine Who Pays 6th Edition Itep

Maine S Governor Proposes To Replace The Income Tax With A Broader Sales Tax Tax Foundation

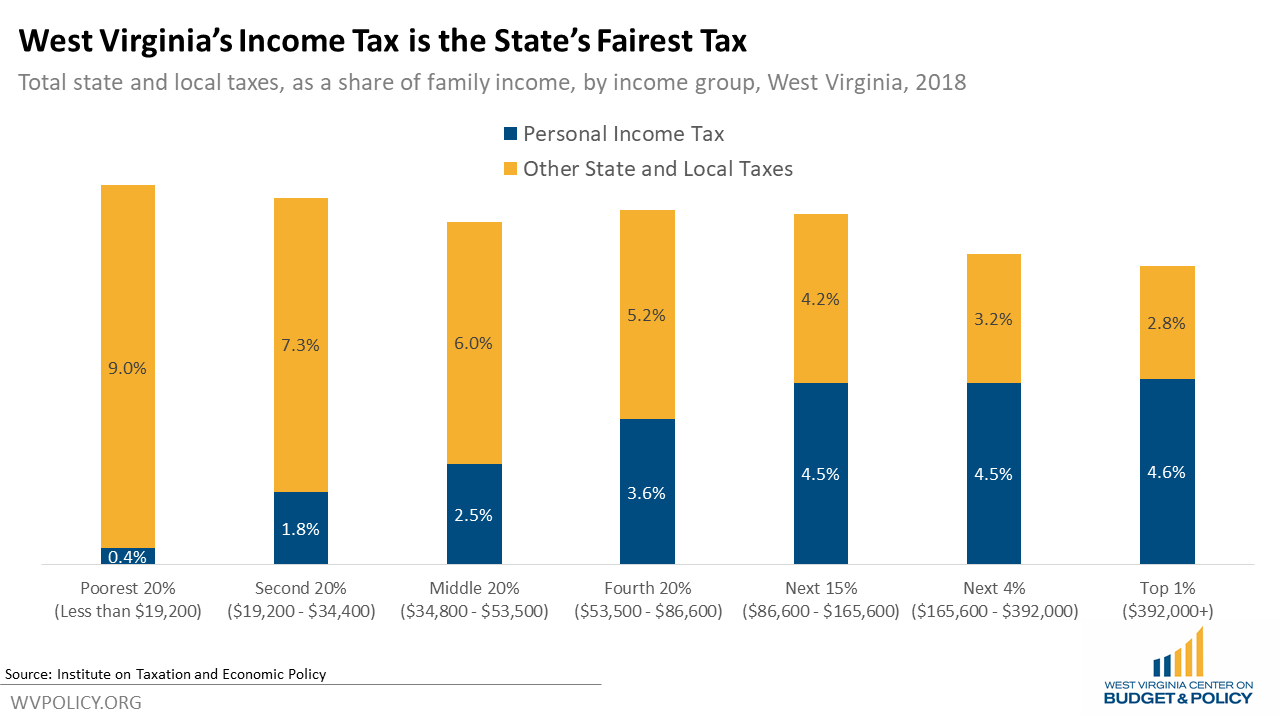

Eliminating The Income Tax Benefits The Wealthy While Undermining Important Public Investments West Virginia Center On Budget Policy